CE Bank Statement and Reconciliation

Description:

Application: Cash Management Description: Bank Statements - Bank Statement Details and Reconciliation

Provides equivalent functionality to the following standard Oracle Forms/Reports

- Bank Statements and Reconciliation Form Applicable Templates: Pivot: Bank Statement by Transaction Type Bank Statement Detail Bank Statement Detail with Reconciled Trxs

- Bank Statement Summary Report Applicable Templates: Pivot: Bank Statement by Transaction Type Bank Statement Summary

- Bank Statement Detail Report Applicable Templates: Pivot: Bank Statement by Transaction Type Bank Statement Detail Bank Statement Detail with Reconciled Trxs

This Blitz Report offers an extended set of parameters over and above the standard form/reports to search for specific reconciled transactions.

Sources: Bank Statement Detail Report (CEXSTMRR) Bank Statement Summary Report (CEXSTMSR) DB package: CE_CEXSTMRR_XMLP_PKG (required to initialize security)

Parameters

Bank Name, Bank Branch, Bank Account Name, Bank Account Number, Check Digits, Statement Date From, Statement Date To, Statement GL Date From, Statement GL Date To, Statement Number From, Statement Number To, Document Number From, Document Number To, Statement Currency, Statement Line Status, Statement Complete, Trx Date From, Trx Date To, Payer/Payee Name Like, Trx Type, Trx Number, Invoice Number, Trx Amount, Trx Currency, Display Reconciled Transactions, Transaction Cleared Date From, Transaction Cleared Date To

Used tables

gl_daily_conversion_types, gl_je_lines, ap_checks_all, ar_cash_receipt_history_all, ce_cashflows, fnd_currencies, ce_statement_lines, pay_assignment_actions, pay_pre_payments, pay_action_interlocks, ce_999_interface_v, xtr_settlement_summary, ce_reconciled_transactions_v

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

Report SQL

www.enginatics.com/reports/ce-bank-statement-and-reconciliation/

Blitz Report™ import options

CE_Bank_Statement_and_Reconciliation.xml

Case Study: Streamlining Cash Reconciliation with Oracle Cash Management

Executive Summary

The CE Bank Statement and Reconciliation report is the cornerstone of cash visibility within Oracle E-Business Suite. It provides a unified view of bank statement activity and the corresponding system transactions (Payments and Receipts), enabling treasury and accounting teams to rapidly identify unreconciled items, monitor cash positions, and close the books with confidence.

Business Challenge

Cash reconciliation is often one of the most labor-intensive processes in finance. Discrepancies between the bank statement and the general ledger can arise from numerous sources:

- Timing Differences: Checks issued but not yet cleared, or deposits in transit.

- Bank Fees & Interest: Miscellaneous charges on the bank statement that have not yet been recorded in the system.

- Data Volume: High volumes of transactions making manual matching prone to error.

- Visibility Gaps: Lack of a single view that combines data from Accounts Payable, Accounts Receivable, and the Bank Statement interface.

The Solution

This report acts as a “Reconciliation Hub,” pulling data from the Bank Statement Interface tables and joining it with the reconciled system transactions. It effectively replicates and enhances the visibility provided by the standard Bank Statement Detail and Summary reports.

Key Features

- Reconciliation Status: Clearly flags transactions as Reconciled, Unreconciled, or Error.

- Cross-Module Visibility: Links bank lines to AP Payments (

AP_CHECKS_ALL), AR Receipts (AR_CASH_RECEIPTS_ALL), and GL Journal Lines (GL_JE_LINES). - Transaction Matching: Displays the specific system transaction number (Check Number, Receipt Number) matched to the bank line.

- Variance Analysis: Highlights differences between the bank amount and the system amount to identify partial matches or exchange rate variances.

Technical Architecture

The solution leverages the robust Oracle Cash Management schema, specifically the tables that handle the storage of bank statement files (MT940, BAI2) and their mapping to system transactions.

Critical Tables

CE_STATEMENT_HEADERS: Represents the bank statement file header (Bank Account, Statement Date).CE_STATEMENT_LINES: Contains the individual line items from the bank statement (Deposits, Withdrawals, Fees).CE_RECONCILED_TRANSACTIONS_V: A key view that links statement lines to their matched system transactions.CE_CASHFLOWS: Handles miscellaneous transfers and manual cash entries.AP_CHECKS_ALL/AR_CASH_RECEIPT_HISTORY_ALL: The source tables for the subledger transactions being reconciled.

Key Parameters

- Bank Account: The specific internal bank account being analyzed.

- Statement Date Range: The period of banking activity to review.

- Status: Filter for

Unreconciledto focus purely on open items, orReconciledfor audit purposes. - Transaction Type: Filter by specific activity types (e.g., PAYMENT, RECEIPT, MISC).

Functional Analysis

Use Cases

- Daily Reconciliation: Treasury analysts run this report daily to match the previous day’s bank feed against system activity.

- Period-End Close: The report serves as the supporting schedule for the Cash GL account balance, proving the “Adjusted Bank Balance” equals the “Book Balance.”

- Audit Defense: Provides a historical record of exactly which system transaction cleared a specific bank line item.

FAQ

Q: Does this report show transactions that are in the system but not on the bank statement? A: Primarily, this report focuses on the Bank Statement perspective (what is on the statement). However, by filtering for unreconciled system transactions (available in related reports), users can find the inverse.

Q: How are foreign currency transactions handled? A: The report includes columns for both the Transaction Currency (e.g., invoice currency) and the Bank Currency, allowing for validation of exchange rates used during clearing.

Q: Can this report handle manual reconciliation?

A: Yes, whether the reconciliation was performed automatically by the AutoReconciliation program or manually by a user, the link is preserved in the CE_RECONCILED_TRANSACTIONS_V view.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

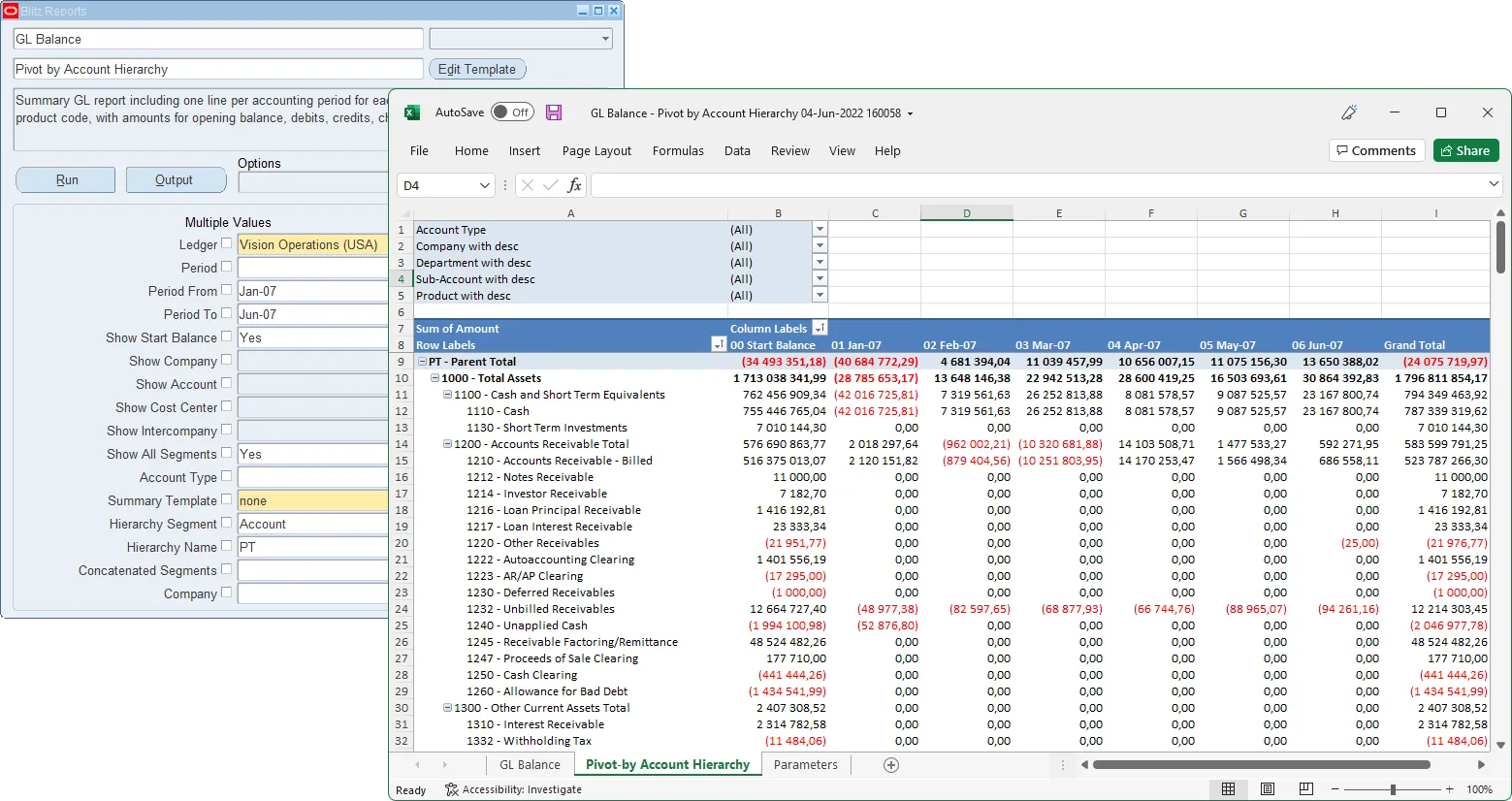

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

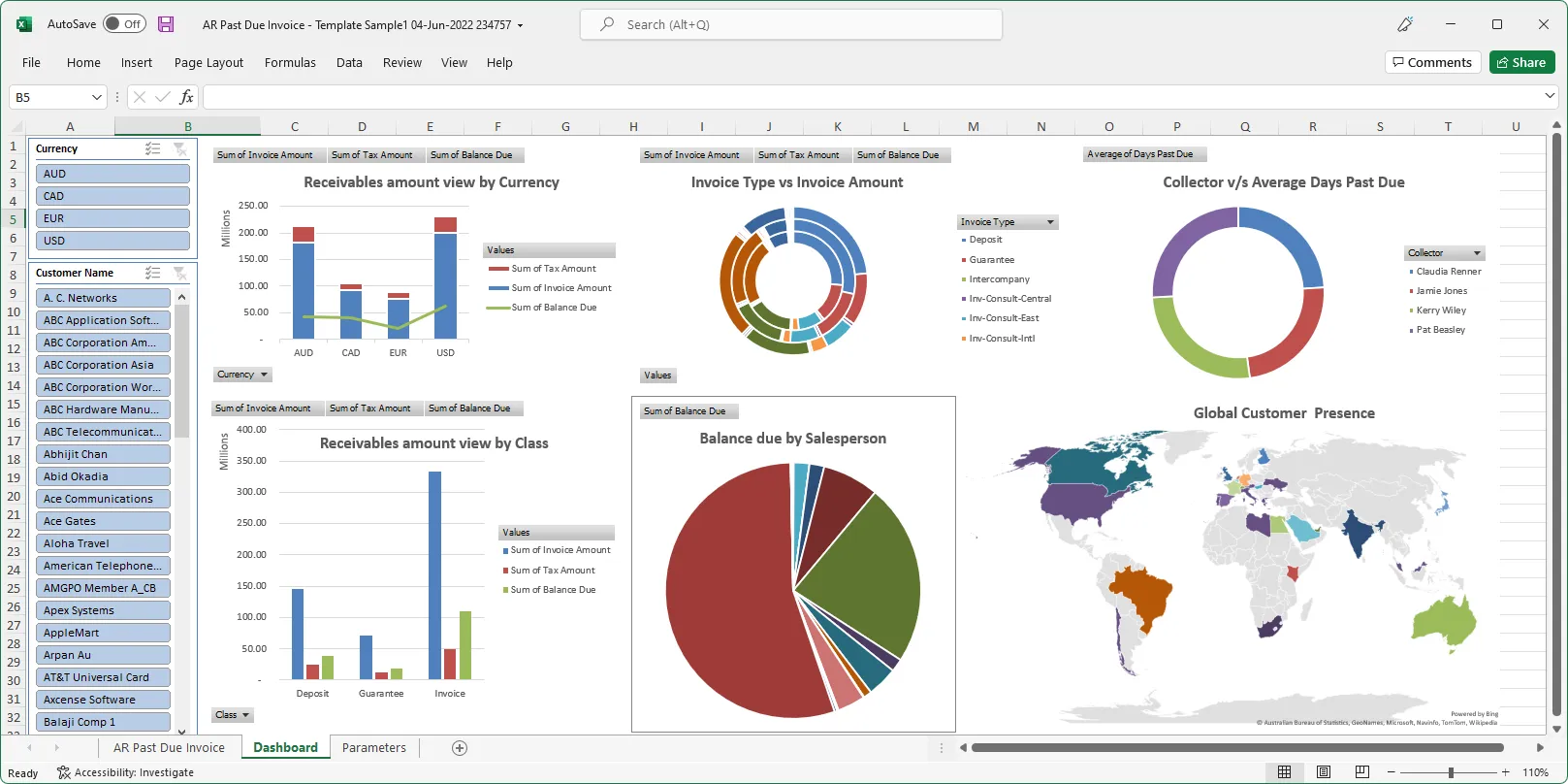

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics